Accept Payments Securely

and Cost-Effectively

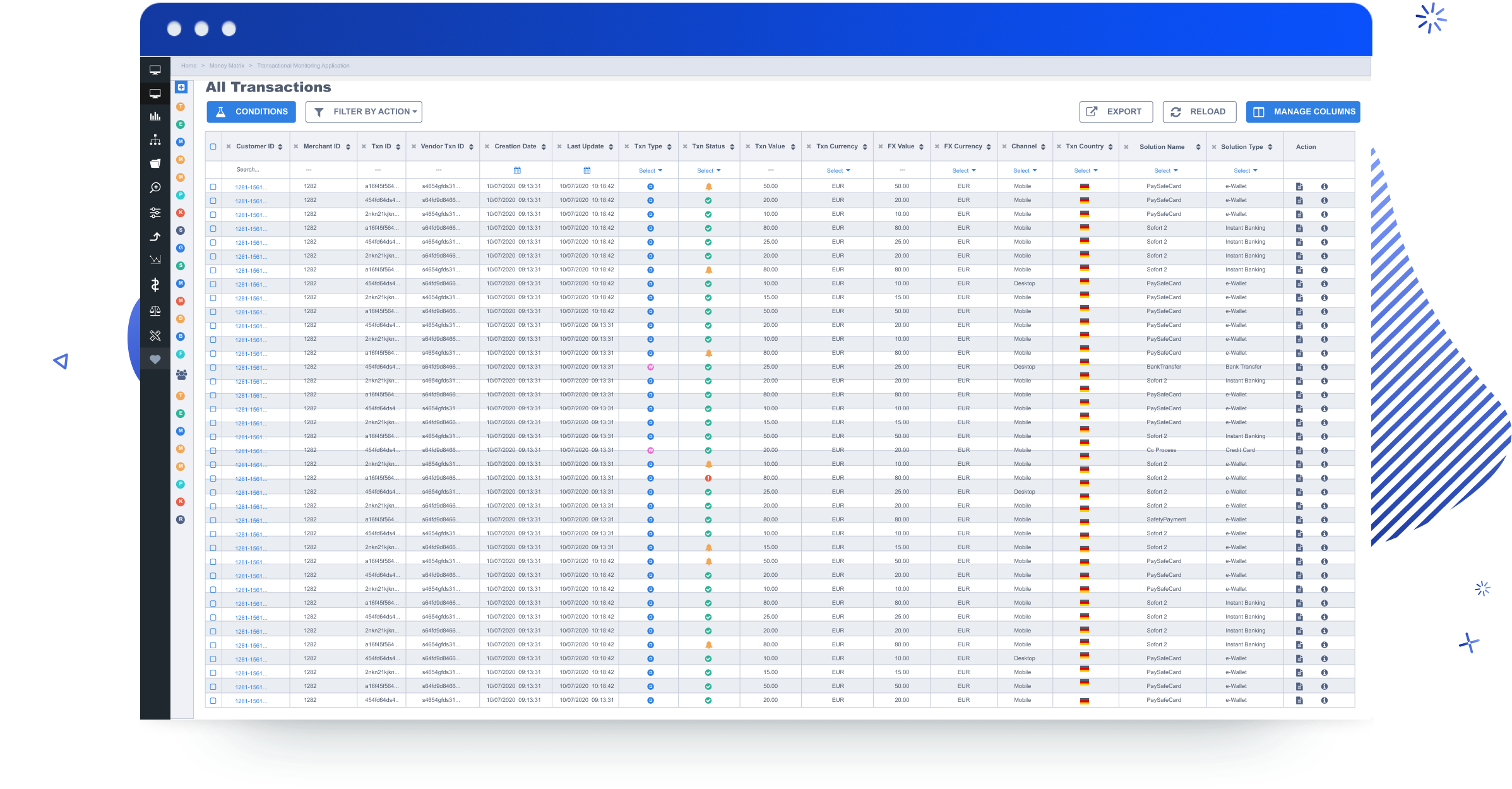

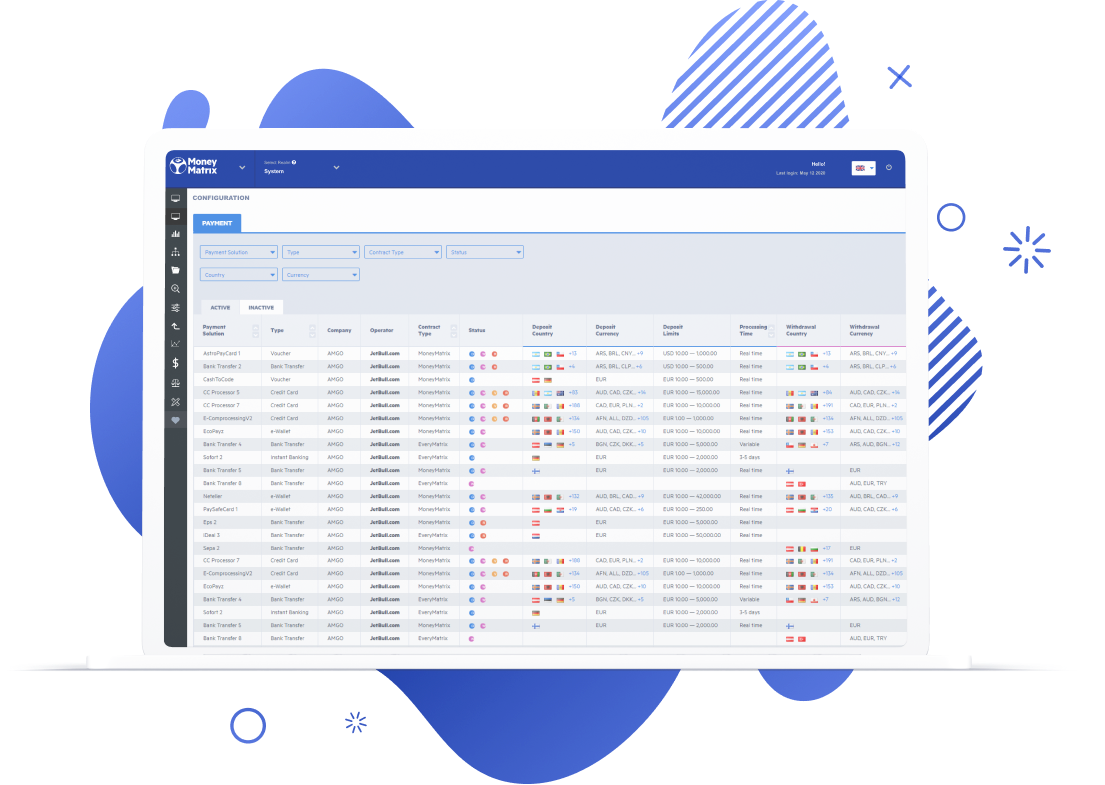

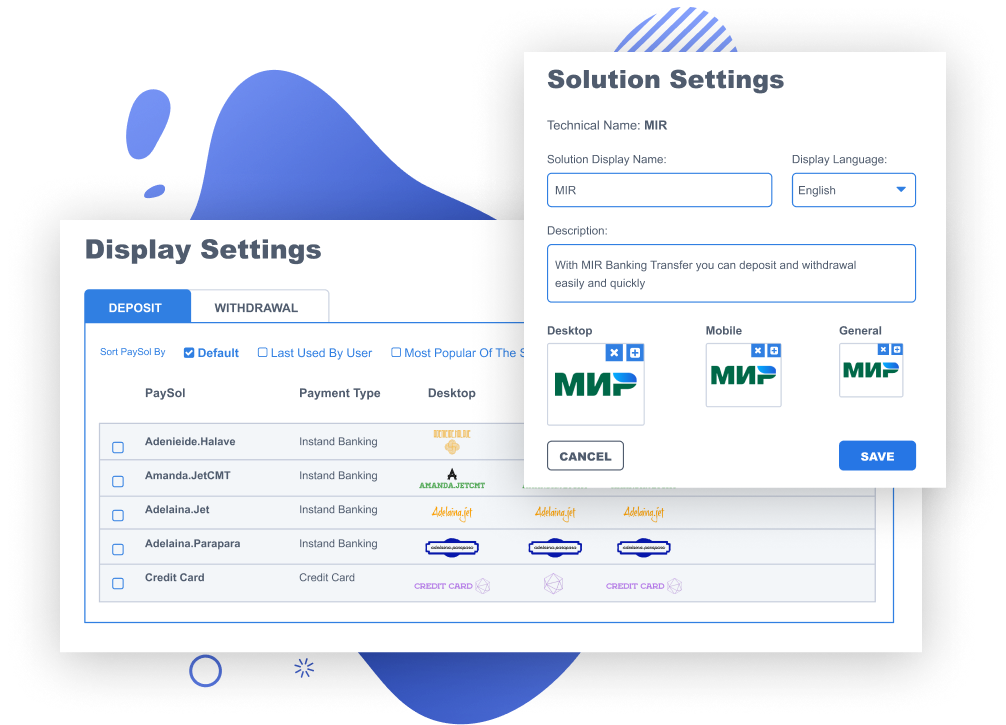

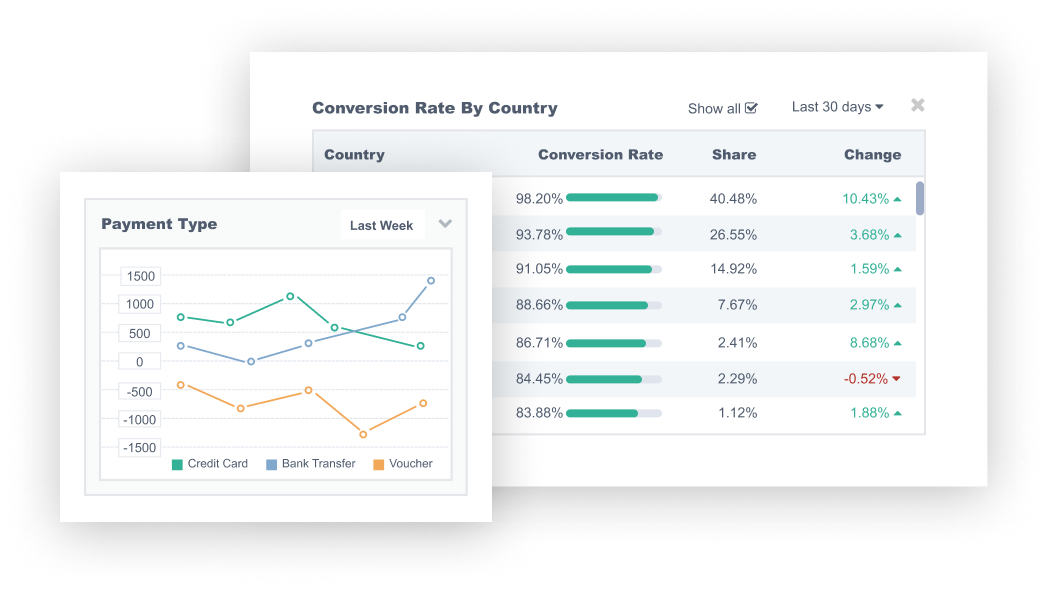

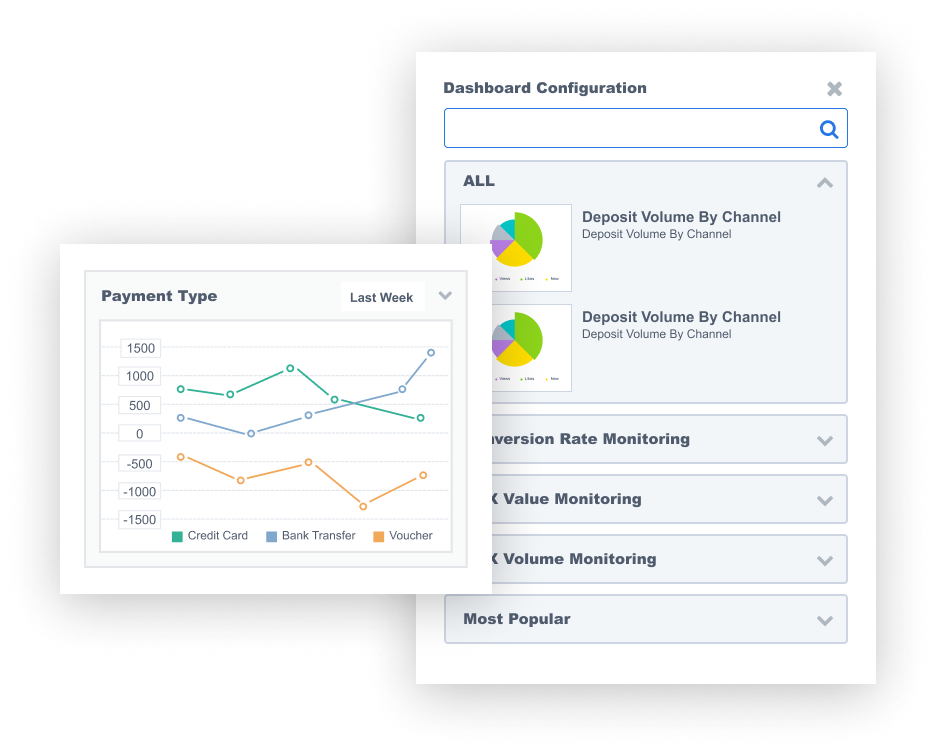

The MoneyMatrix Payment Gateway allows merchants to consolidate all client, risk, KYC and transactional data in the back office. Our transaction monitoring application, rules engine and workspaces create an intuitive work management process flow, allowing you to accept and process out payments efficiently.

As a PCI DSS Level 1 Certified processor, you can rest assured your data is encrypted to the highest standard. Security of your client data is our number one priority with dedicated Card Vault storage, and failover and disaster recovery.